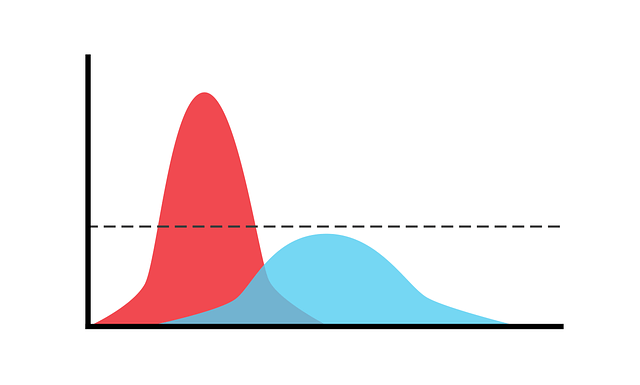

Since the outbreak of coronavirus (Covid-19) pandemic, the term “ Flattening The Curve “ is mentioned daily in the news by medical officials around the world. This term was coined by a medical historian named Dr. Howard Markel from University of Michigan and what it means in epidemiology is to slow the rate of infection for contagious diseases . Anyone watching the news would noticed that the curve is presented in a statistical chart where the ascending curve shows that the rate of infection is increasing and the descending curve after reaching its peak indicates a decreasing rate of infection.

While watching the news and reading about this subject, I noticed that the chart is similar to a business chart showing the performance of a Company. In the case of a Company , a descending curve indicates deterioration of business income and profits. This is a dilemma where most businesses in Malaysia and the rest of world are facing currently due to the movement restriction control (MCO).

As you know, the Malaysian government has allocated a financial aid of RM 10 billion for SME companies recently. From this total sum, RM 2.1 billion in the form of grants benefit 700,000 micro SMEs as each of them are expected to receive RM 3,000/-. Based on these figures, I was wondering what will happen to the rest of the SME companies because there are approximately 1.3 million private limited companies and 7.6 million sole-proprietorship / partnership registered with Companies Commission of Malaysia (CCM or SSM).

It is without a doubt that the issue of funding for operational cost and settling of debts are the most worrisome thing in the minds of all business owners at the moment. Under such circumstances never seen before , it is going to be an unforgettable lesson for all on the importance of savings and putting aside contingency funds for rainy days.

I know its tough to talk about contingency funds at this moment when some business owners could not even afford to maintain their operational cost for another two weeks. Having said that, let us not discount the fact that there are companies which have the reserves to mitigate contingency budgets.

While figuring out how to overcome the business challenges ahead after MCO is lifted, it is also time for business owners to take the opportunity during this period of MCO to plan and organise the distribution and funding for their family in the event of death. I presumed that this planning would be made difficult in normal times because everyone will be saying they are too busy for this.

This reminds me of an incident last year which happened to a business owner who frequently travels overseas for business and have very little time for himself . While on a business trip last year with his staff , he died of a heart attack. Later, it was discovered that he did not leave behind a will.

His wife who is a housewife seems to be in the dark about his assets and business. It is quite common to hear about this and most of the time the wife is not involved in the business, do not know how many bank accounts the husband had, clueless about his investments , unaware of the number of insurance policies he left behind and do not know whether there is any nomination done for the insurance and EPF . On top of that, she does not even know the kind of debts the estate has to settle.

When it comes to settling of debts, I have seen a widower who nearly had a nervous breakdown when she discovers the amount of business and credit card debts her husband owed to a bank and the family does not have the funds to settle the debts.

One of the options which I can think of besides a will to provide immediate funding for covering debts would be setting up a “Private Trust” . This is a contingency plan assuming that the spouse would not be able to handle it and the children are still minors.

The source of funding can be from cash, investment or an insurance policy as liquidity is utmost important currently. When a business owner creates the Trust, he is known as the Settlor. In the Trust he has to appoint a trust company as the Trustee. The reason for appointing a trust company is to ensure continuity, experience, knowledge and professionalism.

Subsequently, the Settlor can appoint a Protector as a watchdog in the trust for the beneficiaries. Finally, he can named his beneficiaries. Once the settlor has decided on the trust company, protector, beneficiaries and instruction on distribution together with the assets placed into the trust, then a trust deed is drawn up to be signed by the settlor and trustee.

Funding from either cash injected or an insurance policy assigned to the Trust can immediately be used upon obtaining the settlor’s death certificate.

If such a trust is created, it can at least give a peace of mind to the family as far as immediate funding is concerned to reduce household debts and this to me is like flattening the curve of debts through estate planning.

Lastly , my prayers to all of you to stay safe, stay healthy , stay strong and stay focus on estate planning.

Image by Markéta Machová from Pixabay